- Reports Total Revenues of

$3.94 Billion ;U.S. GAAP Net Earnings of$332 Million ; Adjusted EBITDA of$1.36 Billion ;U.S. GAAP Net Cash Provided by Operating Activities of$834 Million ; and Free Cash Flow of$738 Million for the Quarter - Strong Results Signal Continuation of Growth Journey with

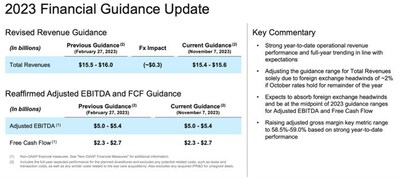

Second Consecutive Quarter of Year-over-Year Operational Revenue Growth on a Divestiture-Adjusted Basis[2] - Revises Full-Year Total Revenues Guidance Range Solely to Reflect the Expected Negative Impact of Foreign Exchange

- On Track to Complete All Planned Divestitures by the End of the First Half of 2024[3]

- Board of Directors Declares Quarterly Dividend of

$0.12 Per Share

Executive Commentary

Viatris CFO

|

[1] Viatris is not providing forward-looking guidance for |

|

[2] For the three months ended |

|

[3] Divestitures are subject to regulatory approvals, completion of any consultations with employee representatives (where applicable), receipt of required consents and other closing conditions, including, in the case of the API business divestiture, a financing condition. |

2023 Financial Guidance

The Company is not providing forward-looking guidance for

Return of Capital to Shareholders

Conference Call and Earnings Materials

Investors and the general public are invited to listen to a live webcast of the call at investor.viatris.com or by calling 800.274.8461 or 203.518.9783 for international callers (Conference ID: VTRSQ323). The "

|

Financial Summary |

|||||||||

|

Three Months Ended |

|||||||||

|

|

|||||||||

|

(Unaudited; in millions, except %s) |

2023 |

2022 |

Reported |

Operational |

Divestiture- |

||||

|

Total |

|

|

(3) % |

(3) % |

1 % |

||||

|

Developed Markets |

2,408.5 |

2,431.5 |

(1) % |

(4) % |

2 % |

||||

|

Emerging Markets |

642.5 |

678.9 |

(5) % |

— % |

2 % |

||||

|

JANZ |

334.5 |

383.0 |

(13) % |

(8) % |

(6) % |

||||

|

|

548.4 |

574.0 |

(4) % |

— % |

— % |

||||

|

|

|||||||||

|

Brands |

|

|

— % |

(1) % |

(1) % |

||||

|

Complex Gx |

174.4 |

320.2 |

(46) % |

(46) % |

25 % |

||||

|

Generics |

1,226.4 |

1,206.9 |

2 % |

3 % |

3 % |

||||

|

|

|

|

(3) % |

||||||

|

|

42.9 % |

42.9 % |

|||||||

|

Adjusted Gross Profit (3) |

|

|

(5) % |

||||||

|

Adjusted Gross Margin (3) |

59.2 % |

60.5 % |

|||||||

|

|

$ 331.6 |

$ 354.3 |

(6) % |

||||||

|

Adjusted Net Earnings (3) |

$ 952.8 |

|

(10) % |

||||||

|

EBITDA (3) |

|

|

(4) % |

||||||

|

Adjusted EBITDA (3) |

|

|

(9) % |

(9) % |

(6) % |

||||

|

|

$ 834.1 |

$ 869.0 |

(4) % |

||||||

|

Capital expenditures |

95.9 |

103.9 |

(8) % |

||||||

|

Free cash flow (3) (4) |

$ 738.2 |

$ 765.1 |

(4) % |

||||||

|

___________ |

|

|

(1) |

Represents operational change for net sales and adjusted EBITDA which excludes the impacts of foreign currency translation. See "Certain Key Terms and Presentation Matters" in this release for more information. |

|

(2) |

Represents adjustments for impact of the biosimilars divestitures in |

|

(3) |

Non-GAAP financial measures. See "Non-GAAP Financial Measures" for additional information. |

|

(4) |

Excluding the impact of transaction costs primarily related to the divestitures and the eye care acquisitions of |

|

Nine Months Ended |

|||||||||

|

|

|||||||||

|

(Unaudited; in millions, except %s) |

2023 |

2022 |

Reported |

Operational |

Divestiture- |

||||

|

Total |

$ 11,562.5 |

$ 12,351.0 |

(6) % |

(4) % |

— % |

||||

|

Developed Markets |

6,932.7 |

7,386.7 |

(6) % |

(6) % |

— % |

||||

|

Emerging Markets |

1,932.5 |

2,035.0 |

(5) % |

2 % |

4 % |

||||

|

JANZ |

1,052.2 |

1,233.9 |

(15) % |

(8) % |

(8) % |

||||

|

|

1,645.1 |

1,695.4 |

(3) % |

2 % |

2 % |

||||

|

|

|||||||||

|

Brands |

|

|

(2) % |

— % |

— % |

||||

|

Complex Gx |

449.7 |

1,065.8 |

(58) % |

(58) % |

(19) % |

||||

|

Generics |

3,714.7 |

3,707.7 |

— % |

3 % |

4 % |

||||

|

|

|

|

(7) % |

||||||

|

|

41.8 % |

42.2 % |

|||||||

|

Adjusted Gross Profit (3) |

|

|

(6) % |

||||||

|

Adjusted Gross Margin (3) |

59.7 % |

59.5 % |

|||||||

|

|

$ 820.3 |

|

(23) % |

||||||

|

Adjusted Net Earnings (3) |

|

|

(14) % |

||||||

|

EBITDA (3) |

|

|

(9) % |

||||||

|

Adjusted EBITDA (3) |

|

|

(12) % |

(10) % |

(7) % |

||||

|

|

|

|

(17) % |

||||||

|

Capital expenditures |

211.5 |

252.3 |

(16) % |

||||||

|

Free cash flow (3) (4) |

|

|

(18) % |

||||||

|

___________ |

|

|

(1) |

Represents operational change for net sales and adjusted EBITDA which excludes the impacts of foreign currency translation. See "Certain Key Terms and Presentation Matters" in this release for more information. |

|

(2) |

Represents adjustments for impact of the biosimilars divestitures in |

|

(3) |

Non-GAAP financial measures. See "Non-GAAP Financial Measures" for additional information. |

|

(4) |

Excluding the impact of transaction costs primarily related to the divestitures and the eye care acquisitions of |

Financial Highlights

- Third quarter 2023 total net sales totaled

$3.93 billion , up 1% on a divestiture-adjusted operational basis (as defined in "Certain Key Terms and Presentation Matters" below) compared to Q3 2022 results. - Brands performed in line with expectations, reflecting solid year-over-year performance in key brands including Yupelri® and Dymista® and sales from Tyrvaya®.

- Complex generics performed slightly below expectations due to phasing of new product launches.

- Generics, which include diversified product forms such as oral solids, injectables, transdermals and topicals, performed ahead of expectations due to solid performance across broader portfolio in Developed and Emerging Markets.

- The Company generated approximately

$135 million in new product revenues (as defined in "Certain Key Terms and Presentation Matters" below) in the third quarter (approximately$345 million for the year to date) primarily driven by lenalidomide and Breyna™ in theU.S. We expect to deliver more than$450 million in new product revenues in 2023. - The Company had

U.S. GAAP net cash provided by operating activities of$834 million in the third quarter ($2.32 billion for the year to date) and generated$738 million of free cash flow in the third quarter ($2.11 billion for the year to date), primarily driven by strong operating results and the timing of planned capital expenditures.U.S. GAAP net cash provided by operating activities and free cash flow for the third quarter included approximately$48 million ($79 million for the year to date) of transaction costs primarily related to the eye care acquisitions and the divestitures. - The Company paid down

$23 million in debt in the third quarter ($750 million for the year to date). The Company remains fully committed to maintaining its investment grade credit rating.

Certain Key Terms and Presentation Matters

New product sales, new product launches or new product revenues: Refers to revenue from new products launched in 2023 and the carryover impact of new products, including business development, launched within the last twelve months.

Operational change: Refers to constant currency percentage changes and is derived by translating amounts for the current period at prior year comparative period exchange rates, and in doing so shows the percentage change from 2023 constant currency net sales, revenues and adjusted EBITDA to the corresponding amount in the prior year.

Divestiture-adjusted operational change: Refers to operational changes, further adjusted for the impact of the biosimilars divestiture in

SG&A and R&D TSA reimbursement: Expenses related to

Non-GAAP Financial Measures

This press release includes the presentation and discussion of certain financial information that differs from what is reported under accounting principles generally accepted in

About

Forward-Looking Statements

This release contains "forward-looking statements". These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, 2023 financial guidance;

|

ViatrisInc. and Subsidiaries Condensed Consolidated Statements of Operations (Unaudited) |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions, except per share amounts) |

2023 |

2022 |

2023 |

2022 |

|||

|

Revenues: |

|||||||

|

Net sales |

$ 3,933.9 |

$ 4,067.4 |

$ 11,562.5 |

$ 12,351.0 |

|||

|

Other revenues |

8.0 |

10.8 |

27.1 |

35.7 |

|||

|

Total revenues |

3,941.9 |

4,078.2 |

11,589.6 |

12,386.7 |

|||

|

Cost of sales |

2,250.6 |

2,329.8 |

6,747.5 |

7,163.8 |

|||

|

Gross profit |

1,691.3 |

1,748.4 |

4,842.1 |

5,222.9 |

|||

|

Operating expenses: |

|||||||

|

Research and development |

211.2 |

174.9 |

602.4 |

479.8 |

|||

|

Acquired IPR&D |

1.0 |

— |

11.2 |

— |

|||

|

Selling, general and administrative |

1,053.5 |

1,017.3 |

3,044.3 |

2,913.7 |

|||

|

Litigation settlements and other contingencies, net |

(26.1) |

(3.9) |

(36.5) |

13.2 |

|||

|

Total operating expenses |

1,239.6 |

1,188.3 |

3,621.4 |

3,406.7 |

|||

|

Earnings from operations |

451.7 |

560.1 |

1,220.7 |

1,816.2 |

|||

|

Interest expense |

141.5 |

153.2 |

432.2 |

445.3 |

|||

|

Other (income) expense, net |

(92.0) |

(20.6) |

(269.4) |

26.6 |

|||

|

Earnings before income taxes |

402.2 |

427.5 |

1,057.9 |

1,344.3 |

|||

|

Income tax provision |

70.6 |

73.2 |

237.6 |

276.9 |

|||

|

Net earnings |

$ 331.6 |

$ 354.3 |

$ 820.3 |

$ 1,067.4 |

|||

|

Earnings per share attributable to |

|||||||

|

Basic |

$ 0.28 |

$ 0.29 |

$ 0.68 |

$ 0.88 |

|||

|

Diluted |

$ 0.27 |

$ 0.29 |

$ 0.68 |

$ 0.88 |

|||

|

Weighted average shares outstanding: |

|||||||

|

Basic |

1,199.5 |

1,212.5 |

1,200.4 |

1,211.8 |

|||

|

Diluted |

1,207.6 |

1,218.1 |

1,205.6 |

1,216.1 |

|||

|

ViatrisInc. and Subsidiaries Condensed Consolidated Balance Sheets (Unaudited) |

|||

|

(In millions) |

|

|

|

|

ASSETS |

|||

|

Assets |

|||

|

Current assets: |

|||

|

Cash and cash equivalents |

$ 1,309.6 |

$ 1,259.9 |

|

|

Accounts receivable, net |

3,738.5 |

3,814.5 |

|

|

Inventories |

3,671.9 |

3,519.5 |

|

|

Prepaid expenses and other current assets |

1,784.7 |

1,811.2 |

|

|

Assets held for sale |

427.3 |

230.3 |

|

|

Total current assets |

10,932.0 |

10,635.4 |

|

|

Intangible assets, net |

21,280.5 |

22,607.1 |

|

|

|

10,278.1 |

10,425.8 |

|

|

Other non-current assets |

6,252.0 |

6,353.9 |

|

|

Total assets |

$ 48,742.6 |

$ 50,022.2 |

|

|

LIABILITIES AND EQUITY |

|||

|

Liabilities |

|||

|

Current portion of long-term debt and other long-term obligations |

$ 1,307.4 |

$ 1,259.1 |

|

|

Liabilities held for sale |

14.3 |

— |

|

|

Other current liabilities |

5,512.3 |

5,487.1 |

|

|

Long-term debt |

17,076.9 |

18,015.2 |

|

|

Other non-current liabilities |

3,966.1 |

4,188.5 |

|

|

Total liabilities |

27,877.0 |

28,949.9 |

|

|

Shareholders' equity |

20,865.6 |

21,072.3 |

|

|

Total liabilities and equity |

$ 48,742.6 |

$ 50,022.2 |

|

|

|

|||||

|

Key Product |

|||||

|

(Unaudited) |

|||||

|

Three months ended |

Nine months ended |

||||

|

(In millions) |

2023 |

2022 |

2023 |

2022 |

|

|

Select Key Global Products |

|||||

|

Lipitor ® |

$ 381.6 |

$ 420.4 |

$ 1,179.5 |

|

|

|

Norvasc ® |

175.5 |

189.3 |

560.6 |

600.1 |

|

|

Lyrica ® |

141.7 |

156.5 |

423.1 |

483.9 |

|

|

EpiPen® Auto-Injectors |

131.9 |

114.4 |

355.2 |

309.7 |

|

|

Viagra ® |

110.5 |

117.0 |

336.5 |

361.9 |

|

|

Celebrex ® |

84.7 |

82.2 |

255.5 |

253.4 |

|

|

Creon ® |

77.5 |

76.4 |

224.3 |

226.5 |

|

|

Effexor ® |

65.5 |

64.2 |

194.9 |

215.4 |

|

|

Zoloft ® |

62.7 |

53.1 |

173.7 |

188.7 |

|

|

Xalabrands |

47.9 |

51.0 |

145.0 |

146.7 |

|

|

Select Key Segment Products |

|||||

|

Influvac ® |

$ 137.2 |

$ 159.3 |

$ 137.5 |

$ 178.3 |

|

|

Yupelri ® |

58.3 |

53.4 |

160.3 |

146.1 |

|

|

Dymista ® |

44.1 |

38.6 |

155.0 |

138.0 |

|

|

Amitiza ® |

37.7 |

39.4 |

115.8 |

125.3 |

|

|

Xanax ® |

28.2 |

38.3 |

119.7 |

115.5 |

|

|

____________ |

|

|

(a) |

The Company does not disclose net sales for any products considered competitively sensitive. |

|

(b) |

Products disclosed may change in future periods, including as a result of seasonality, competition or new product launches. |

|

(c) |

Amounts for the three and nine months ended |

|

ViatrisInc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited) |

|||||||

|

Reconciliation of |

|||||||

|

Below is a reconciliation of |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

(In millions) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 331.6 |

$ 354.3 |

$ 820.3 |

$ 1,067.4 |

|||

|

Purchase accounting related amortization (primarily included in cost of sales) (a) |

602.0 |

626.7 |

1,864.6 |

1,930.5 |

|||

|

Litigation settlements and other contingencies, net |

(26.1) |

(3.9) |

(36.5) |

13.2 |

|||

|

Interest expense (primarily amortization of premiums and discounts on long term debt) |

(10.7) |

(10.0) |

(31.5) |

(36.8) |

|||

|

Acquisition and divestiture-related costs (primarily included in SG&A) (b) |

115.7 |

99.2 |

230.1 |

306.3 |

|||

|

Restructuring related costs (c) |

14.9 |

15.0 |

98.7 |

42.0 |

|||

|

Share-based compensation expense |

43.1 |

29.1 |

124.9 |

86.8 |

|||

|

Other special items included in: |

|||||||

|

Cost of sales (d) |

16.7 |

68.9 |

91.9 |

150.4 |

|||

|

Research and development expense |

0.3 |

— |

2.7 |

0.9 |

|||

|

Selling, general and administrative expense |

2.7 |

19.9 |

34.0 |

44.3 |

|||

|

Other income, net (e) |

(26.4) |

(6.3) |

(114.0) |

(8.2) |

|||

|

Tax effect of the above items and other income tax related items (f) |

(111.0) |

(129.4) |

(294.1) |

(342.7) |

|||

|

Adjusted net earnings |

$ 952.8 |

$ 1,063.5 |

$ 2,791.1 |

$ 3,254.1 |

|||

|

____________ |

|

|

Significant items include the following: |

|

|

(a) |

For the nine months ended |

|

(b) |

Acquisition and divestiture-related costs consist primarily of transaction costs including legal and consulting fees and integration activities. |

|

(c) |

For the three and nine months ended |

|

(d) |

For the three and nine months ended |

|

(e) |

For the three months ended |

|

(f) |

Adjusted for changes for uncertain tax positions. |

|

Reconciliation of |

|||||||

|

Below is a reconciliation of |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 331.6 |

$ 354.3 |

$ 820.3 |

$ 1,067.4 |

|||

|

Add adjustments: |

|||||||

|

Income tax provision |

70.6 |

73.2 |

237.6 |

276.9 |

|||

|

Interest expense (a) |

141.5 |

153.2 |

432.2 |

445.3 |

|||

|

Depreciation and amortization (b) |

679.4 |

699.5 |

2,096.1 |

2,157.8 |

|||

|

EBITDA |

$ 1,223.1 |

$ 1,280.2 |

$ 3,586.2 |

$ 3,947.4 |

|||

|

Add / (deduct) adjustments: |

|||||||

|

Share-based compensation expense |

43.1 |

29.1 |

124.9 |

86.8 |

|||

|

Litigation settlements and other contingencies, net |

(26.1) |

(3.9) |

(36.5) |

13.2 |

|||

|

Restructuring, acquisition and divestiture-related and other special items (c) |

120.0 |

192.4 |

332.1 |

518.8 |

|||

|

Adjusted EBITDA |

$ 1,360.1 |

$ 1,497.8 |

$ 4,006.7 |

$ 4,566.2 |

|||

|

___________ |

|

|

(a) |

Includes amortization of premiums and discounts on long-term debt. |

|

(b) |

Includes purchase accounting related amortization. |

|

(c) |

See items detailed in the Reconciliation of |

|

Summary of Total Revenues by Segment |

|||||||||||||||||||

|

Three Months Ended |

|||||||||||||||||||

|

|

|||||||||||||||||||

|

(In millions, except %s) |

2023 |

2022 |

% |

2023 |

2023 |

Constant |

2022 |

2022 |

Divestiture- |

||||||||||

|

Net sales |

|||||||||||||||||||

|

Developed Markets |

|

|

(1) % |

$ (85.0) |

$ 2,323.5 |

(4) % |

$ 162.9 |

$ 2,268.6 |

2 % |

||||||||||

|

|

548.4 |

574.0 |

(4) % |

23.7 |

572.1 |

— % |

0.2 |

573.8 |

— % |

||||||||||

|

JANZ |

334.5 |

383.0 |

(13) % |

18.9 |

353.4 |

(8) % |

5.1 |

377.9 |

(6) % |

||||||||||

|

Emerging Markets |

642.5 |

678.9 |

(5) % |

35.8 |

678.3 |

— % |

12.8 |

666.1 |

2 % |

||||||||||

|

Total net sales |

|

|

(3) % |

$ (6.6) |

$ 3,927.3 |

(3) % |

$ 181.0 |

$ 3,886.4 |

1 % |

||||||||||

|

Other revenues (7) |

8.0 |

10.8 |

NM |

(0.3) |

7.7 |

NM |

|||||||||||||

|

Consolidated total revenues (8) |

|

|

(3) % |

$ (6.9) |

$ 3,935.0 |

(3) % |

|||||||||||||

|

Nine Months Ended |

|||||||||||||||||||

|

|

|||||||||||||||||||

|

(In millions, except %s) |

2023 |

2022 |

% Change |

2023 |

2023 |

Constant |

2022 |

Other (4) |

2022 |

Divestiture- |

|||||||||

|

Net sales |

|||||||||||||||||||

|

Developed Markets |

|

|

(6) % |

$ (23.7) |

$ 6,909.0 |

(6) % |

$ 449.4 |

$ 13.9 |

$ 6,923.4 |

— % |

|||||||||

|

|

1,645.1 |

1,695.4 |

(3) % |

85.1 |

1,730.2 |

2 % |

0.6 |

(4.2) |

1,699.0 |

2 % |

|||||||||

|

JANZ |

1,052.2 |

1,233.9 |

(15) % |

77.6 |

1,129.8 |

(8) % |

14.7 |

(9.7) |

1,228.9 |

(8) % |

|||||||||

|

Emerging Markets |

1,932.5 |

2,035.0 |

(5) % |

143.1 |

2,075.6 |

2 % |

42.8 |

— |

1,992.2 |

4 % |

|||||||||

|

Total net sales |

$ 11,562.5 |

$ 12,351.0 |

(6) % |

$ 282.1 |

$ 11,844.6 |

(4) % |

$ 507.5 |

$ — |

$ 11,843.5 |

— % |

|||||||||

|

Other revenues (7) |

27.1 |

35.7 |

NM |

0.1 |

27.2 |

NM |

|||||||||||||

|

Consolidated total revenues (8) |

$ 11,589.6 |

$ 12,386.7 |

(6) % |

$ 282.2 |

$ 11,871.8 |

(4) % |

|||||||||||||

|

____________ |

|

|

(1) |

Currency impact is shown as unfavorable (favorable). |

|

(2) |

The constant currency percentage change is derived by translating net sales or revenues for the current period at prior year comparative period exchange rates, and in doing so shows the percentage change from 2023 constant currency net sales or revenues to the corresponding amount in the prior year. |

|

(3) |

Represents biosimilars net sales in the relevant period. |

|

(4) |

Represents a reclassification to conform prior year amounts to current year presentation of divestiture-adjusted operational net sales. |

|

(5) |

Represents |

|

(6) |

See "Certain Key Terms and Presentation Matters" in this release for more information. |

|

(7) |

For the three months ended |

|

(8) |

Amounts exclude intersegment revenue which eliminates on a consolidated basis. |

|

Reconciliation of Income Statement Line Items |

|||||||

|

(Unaudited) |

|||||||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions, except %s) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 2,250.6 |

$ 2,329.8 |

$ 6,747.5 |

$ 7,163.8 |

|||

|

Deduct: |

|||||||

|

Purchase accounting related amortization |

(602.0) |

(626.7) |

(1,864.7) |

(1,930.4) |

|||

|

Acquisition and divestiture-related items |

(14.1) |

(16.3) |

(26.7) |

(41.1) |

|||

|

Restructuring related costs |

(9.1) |

(8.6) |

(88.9) |

(28.4) |

|||

|

Share-based compensation expense |

(0.7) |

(0.4) |

(2.2) |

(1.2) |

|||

|

Other special items |

(16.7) |

(68.9) |

(91.9) |

(150.4) |

|||

|

Adjusted cost of sales |

$ 1,608.0 |

$ 1,608.9 |

$ 4,673.1 |

$ 5,012.3 |

|||

|

Adjusted gross profit (a) |

$ 2,333.9 |

$ 2,469.3 |

$ 6,916.5 |

$ 7,374.4 |

|||

|

Adjusted gross margin (a) |

59 % |

61 % |

60 % |

60 % |

|||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions, except %s) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 211.2 |

$ 174.9 |

$ 602.4 |

$ 479.8 |

|||

|

Deduct: |

|||||||

|

Acquisition and divestiture-related costs |

(2.2) |

(2.6) |

(9.2) |

(6.3) |

|||

|

Share-based compensation expense |

(1.5) |

(1.1) |

(4.0) |

(4.1) |

|||

|

SG&A and R&D TSA reimbursement (c) |

(8.6) |

— |

(27.0) |

— |

|||

|

Other special items |

(0.3) |

— |

(2.7) |

(0.9) |

|||

|

Adjusted R&D |

$ 198.6 |

$ 171.2 |

$ 559.5 |

$ 468.5 |

|||

|

Adjusted R&D as % of total revenues |

5 % |

4 % |

5 % |

4 % |

|||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions, except %s) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 1,053.5 |

$ 1,017.3 |

$ 3,044.3 |

$ 2,913.7 |

|||

|

Deduct: |

|||||||

|

Acquisition and divestiture-related costs |

(99.4) |

(80.4) |

(194.1) |

(258.9) |

|||

|

Restructuring and related costs |

(5.8) |

(6.4) |

(9.8) |

(13.6) |

|||

|

Purchase accounting amortization and other related items |

— |

— |

— |

(0.1) |

|||

|

Share-based compensation expense |

(40.9) |

(27.5) |

(118.7) |

(81.5) |

|||

|

SG&A and R&D TSA reimbursement (c) |

(27.6) |

— |

(79.8) |

— |

|||

|

Other special items and reclassifications |

(2.7) |

(19.9) |

(34.0) |

(44.3) |

|||

|

Adjusted SG&A |

$ 877.1 |

$ 883.1 |

$ 2,607.9 |

$ 2,515.3 |

|||

|

Adjusted SG&A as % of total revenues |

22 % |

22 % |

23 % |

20 % |

|||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 1,239.6 |

$ 1,188.3 |

$ 3,621.4 |

$ 3,406.7 |

|||

|

Add / (Deduct): |

|||||||

|

Litigation settlements and other contingencies, net |

26.1 |

3.9 |

36.5 |

(13.2) |

|||

|

R&D adjustments |

(12.6) |

(3.7) |

(42.9) |

(11.3) |

|||

|

SG&A adjustments |

(176.4) |

(134.2) |

(436.4) |

(398.4) |

|||

|

Adjusted total operating expenses |

$ 1,076.7 |

$ 1,054.3 |

$ 3,178.6 |

$ 2,983.8 |

|||

|

Adjusted earnings from operations (b) |

$ 1,257.2 |

$ 1,415.0 |

$ 3,737.9 |

$ 4,390.6 |

|||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 141.5 |

$ 153.2 |

$ 432.2 |

$ 445.3 |

|||

|

Add / (Deduct): |

|||||||

|

Accretion of contingent consideration liability |

(2.0) |

(1.8) |

(6.3) |

(5.6) |

|||

|

Amortization of premiums and discounts on long-term debt |

13.7 |

12.8 |

40.8 |

45.7 |

|||

|

Other special items |

(1.0) |

(1.1) |

(3.0) |

(3.3) |

|||

|

Adjusted interest expense |

$ 152.2 |

$ 163.1 |

$ 463.7 |

$ 482.1 |

|||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ (92.0) |

$ (20.6) |

$ (269.4) |

$ 26.6 |

|||

|

Add / (Deduct): |

|||||||

|

Fair value adjustments on non-marketable equity investments (d) |

19.1 |

— |

115.1 |

— |

|||

|

SG&A and R&D TSA reimbursement (c) |

36.2 |

— |

106.8 |

— |

|||

|

Other items |

7.3 |

6.3 |

(1.1) |

8.2 |

|||

|

Adjusted other (income) expense, net |

$ (29.4) |

$ (14.3) |

$ (48.6) |

$ 34.8 |

|||

|

Three Months Ended |

Nine Months Ended |

||||||

|

|

|

||||||

|

(In millions, except %s) |

2023 |

2022 |

2023 |

2022 |

|||

|

|

$ 402.2 |

$ 427.5 |

$ 1,057.9 |

$ 1,344.3 |

|||

|

Total pre-tax non-GAAP adjustments |

732.1 |

838.5 |

2,264.8 |

2,529.3 |

|||

|

Adjusted earnings before income taxes |

$ 1,134.3 |

$ 1,266.0 |

$ 3,322.7 |

$ 3,873.6 |

|||

|

|

$ 70.6 |

$ 73.2 |

$ 237.6 |

$ 276.9 |

|||

|

Adjusted tax expense |

110.9 |

129.4 |

294.0 |

342.7 |

|||

|

Adjusted income tax provision |

$ 181.5 |

$ 202.6 |

$ 531.6 |

$ 619.6 |

|||

|

Adjusted effective tax rate |

16.0 % |

16.0 % |

16.0 % |

16.0 % |

|||

|

___________ |

|

|

(a) |

|

|

(b) |

|

|

(c) |

Refer to "Certain Key Terms and Presentation Matters" section in this release for more information on reclassifications related to |

|

(d) |

For the three months ended |

|

Reconciliation of Estimated 2023 U.S. GAAP Net Cash Provided by Operating Activities to Free Cash Flow

(Unaudited) |

|

|

A reconciliation of the estimated 2023 U.S. GAAP |

|

|

(In millions) |

|

|

Estimated |

|

|

Less: Capital Expenditures |

|

|

Free Cash Flow (a) |

|

|

___________ |

|

|

(a) |

Includes the full year expected performance for the planned divestitures and excludes any potential related costs, such as taxes and transaction costs, as well as any similar costs related to the eye care acquisitions. Also excludes any acquired IPR&D for unsigned deals. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/viatris-reports-strong-financial-and-operational-results-for-the-third-quarter-2023-and-reaffirms-full-year-2023-adjusted-ebitda-and-free-cash-flow-guidance-ranges1-301980611.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/viatris-reports-strong-financial-and-operational-results-for-the-third-quarter-2023-and-reaffirms-full-year-2023-adjusted-ebitda-and-free-cash-flow-guidance-ranges1-301980611.html

SOURCE

Media, +1.724.514.1968, Communications@viatris.com, Jennifer Mauer, Jennifer.Mauer@viatris.com or Matt Klein, Matthew.Klein@viatris.com; Investors, Bill Szablewski, +1.412.707.2866, InvestorRelations@viatris.com, William.Szablewski@viatris.com